Back Door Roth Ira Conversion 2018

15th in the following year if you decided that you wanted to avoid the tax hit.

Back door roth ira conversion 2018. Deadline for a roth conversion 2018. A do over meant that you could do conversion and then undo the transaction up until oct. For a deeper understanding of this topic you can check out that guide. That post details the tax benefits for choosing a roth ira or an ira.

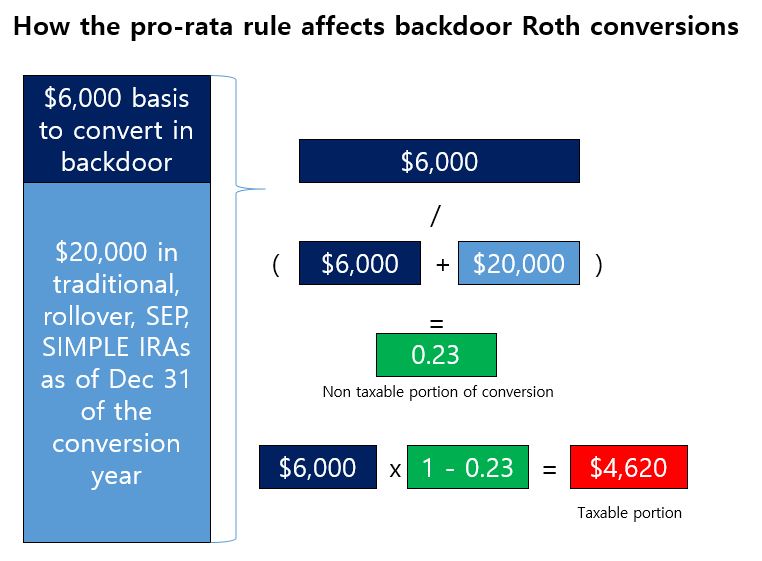

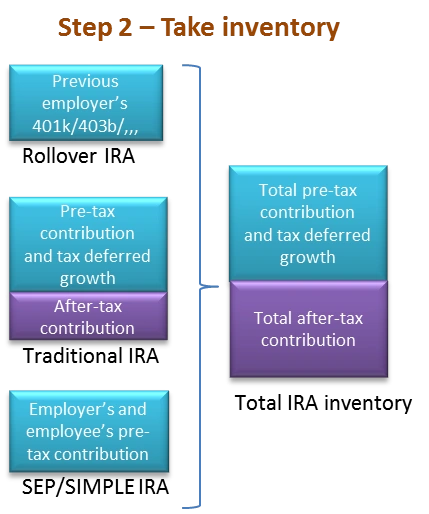

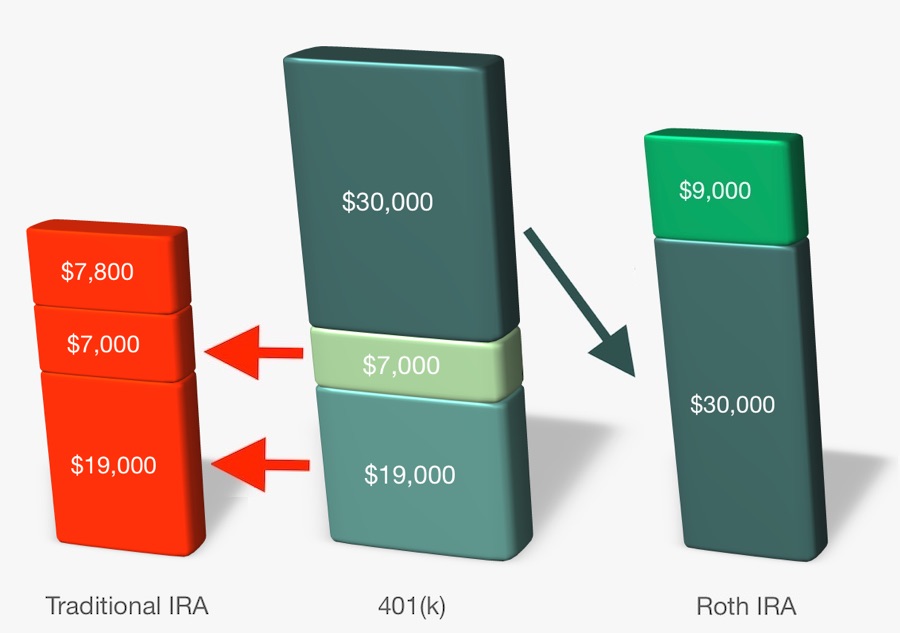

For 2018 individuals cannot make a roth ira contribution if their income exceeds 199 000 married filing jointly or 135 000 single. Return to iras faqs. A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions. For instance if i roll my private ira into a company 401k today 1 11 2018 will i be able to star the back door roth strategy once that roll over is done guessing around 1 18 2018.

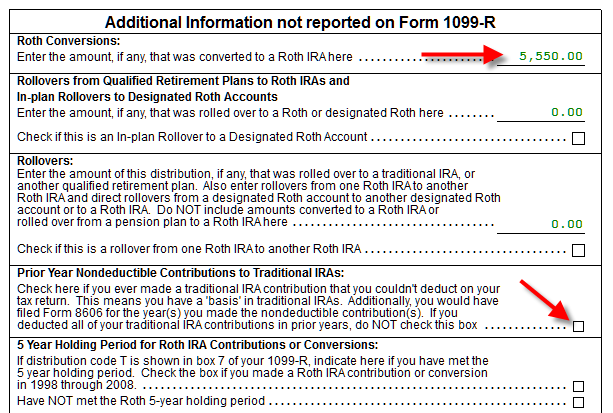

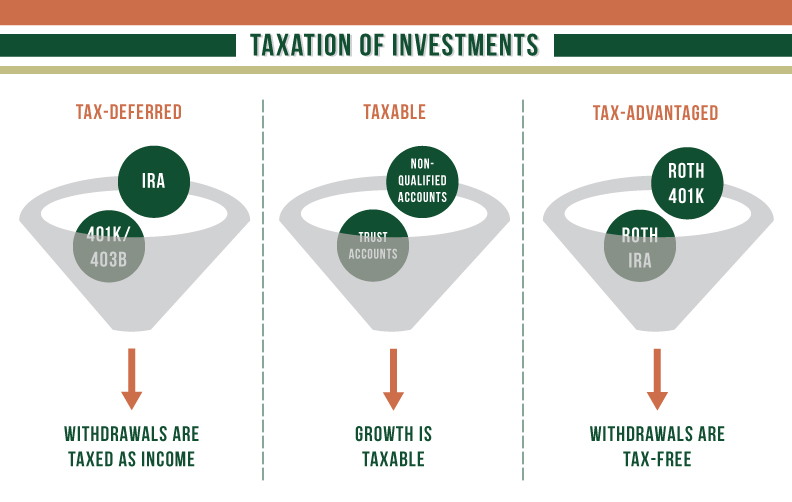

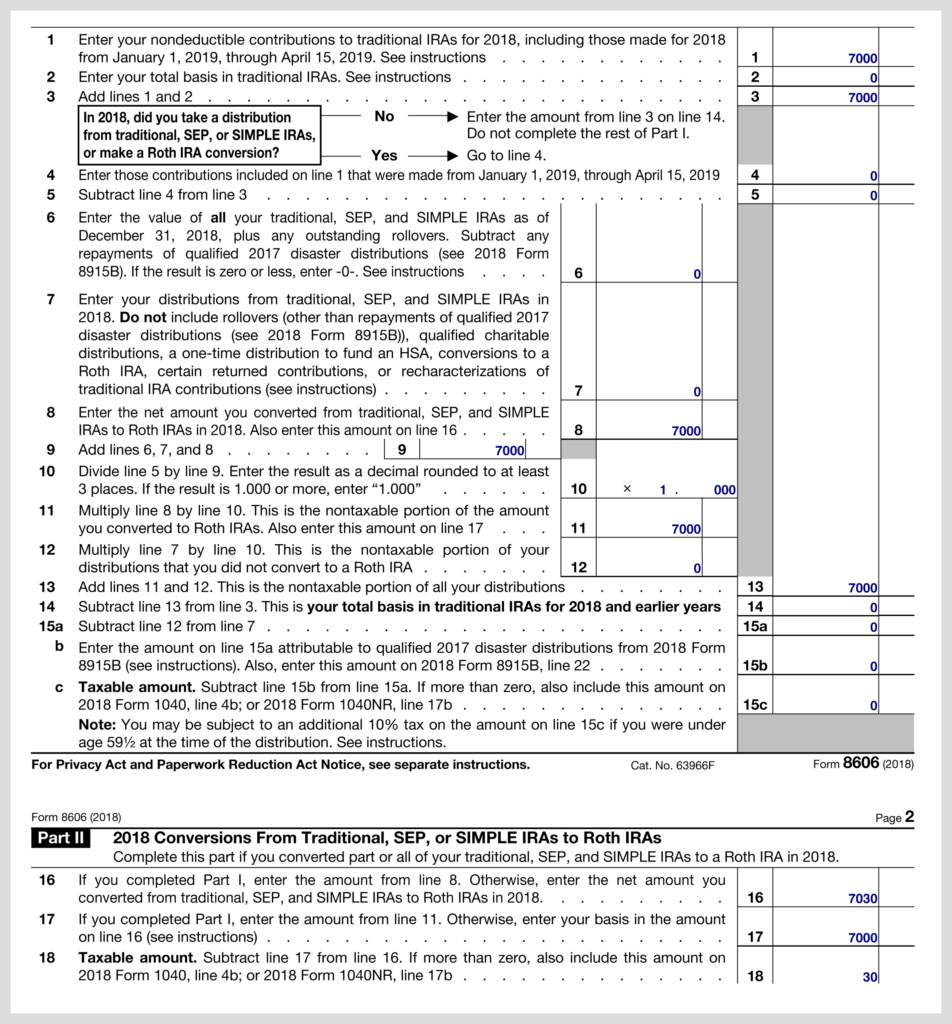

The backdoor roth ira. We get a lot of questions about this. It used to be that you could do over your roth ira conversions. The conversion is reported on form 8606 pdf nondeductible iras.

Or because i had a private ira for the calendar year of 2017 i am not eligible for a back door roth. You can do a roth conversion up until dec. They re complicated but still legal. See publication 590 a contributions to individual retirement arrangements iras for more information.

The back door roth is a work around that lets people move. Why perform a backdoor roth ira conversion. The backdoor roth ira contribution is a strategy and not a product or a type of ira contribution. Therefore you shouldn t ask your ira custodian or trustee for a backdoor roth ira contribution.

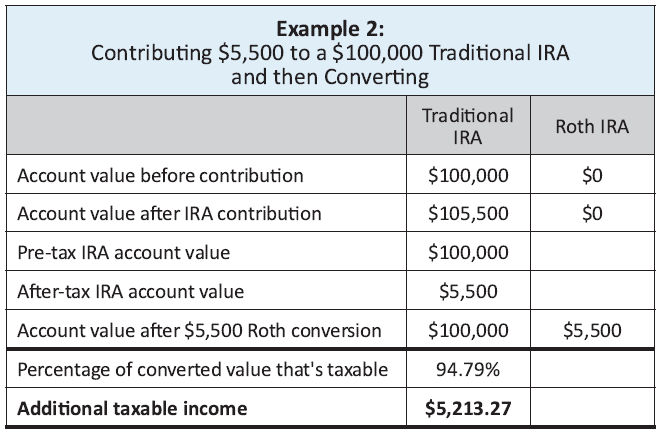

More the complete guide to the roth ira. For 2018 the ability to contribute to a roth ira begins to. A conversion to a roth ira results in taxation of any untaxed amounts in the traditional ira. A backdoor roth ira allows taxpayers to contribute to a roth ira even if their income is higher than the irs approved amount for such contributions.

Backdoor roth ira conversions.